working capital turnover ratio formula class 12

In this formula working capital refers to the operating capital that a company uses in day-to-day operations. Also if credit purchases are not given then all purchases are deemed to be on credit.

Inventory Turnover Ratio In Retail How To Calculate And Improve It Dor

This means that for every 1 spent on the business it is providing net sales of 7.

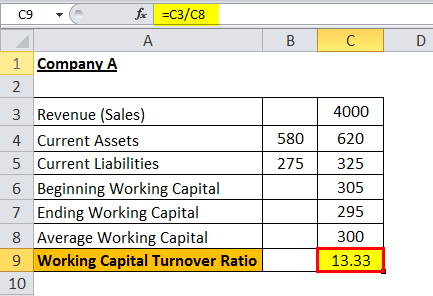

. Working Capital Turnover Formula To calculate the ratio divide net sales by working capital which is current assets minus current liabilities. 100000 40000. The calculation is usually made on an annual or trailing 12-month basis and uses the average working capital during that period.

514405 -17219. Working capital turnover ratio Net Sales Average working capital. I Debt equity Ratio.

Average Collection Period 365 Trade Receivables Turnover Ratio 365 818 45 days. Current Assets 10000 5000 25000 20000 60000. If this ratio is around 12 to 18 This is generally said to be a balanced ratio and it is assumed that the company is in a healthy state to pay its liabilities.

Ratio It is an arithmetical expression of relationship between two related or interdependent items. It reflects relationship between revenue from operations and net assets capital employed in the business. Working Capital Current Assets Current Liabilities.

If it is less than 1 It is known as negative working capital which generally means that the company cannot pay. Meaning of Working Capital Turnover Ratio. Formula For Calculating Working Capital Turnover Ratio.

Using TS Grewal Class 12 solutions Accounting Ratios exercise by students are an easy way to prepare for the exams as they involve solutions arranged chapter-wise also page wise. For Calculation of ratios Formula must be written as it carries marks. Current Assets Current Investments Inventories Excluding Spare Parts and Loose Tools Trade Receivables Cash and Cash Equivalents Short Term Loans and Advances Other Current Assets.

Putting the values in the formula of working capital turnover ratio we get. Long term debtshareholders fund long term debt debentures 20000. Working capital Turnover ratio Net Sales Working Capital.

The companys working capital is the difference between the current assets and current liabilities of a company. Working Capital Turnover Ratio Formula. Working Capital Turnover Ratio Working capital.

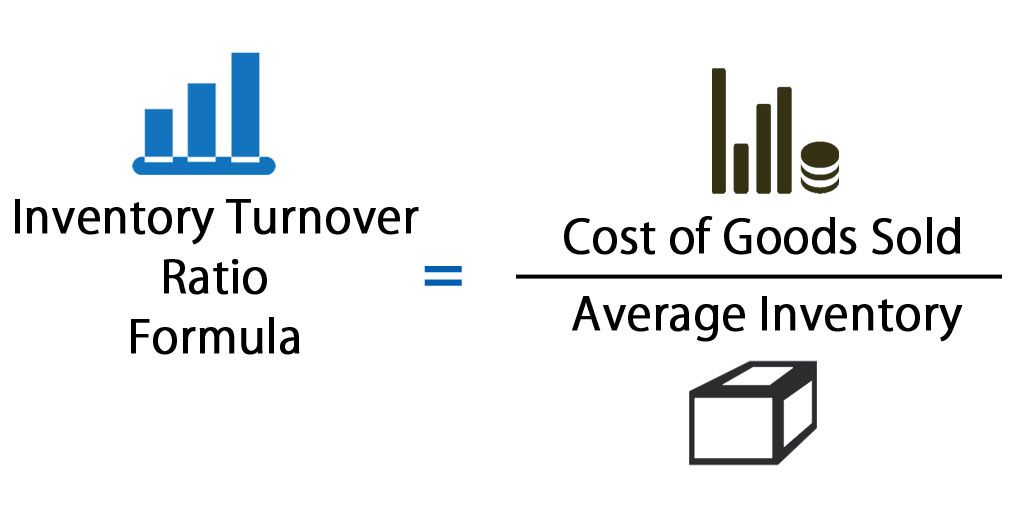

The formula for calculating inventory turnover ratio is as follows. Current Liabilities As On 1st April 2021. Working capital turnover ratio Activityratio class 12 trade payables ratioThis video includesWhat is activity turnover ratioIs current ratio a part.

Working capital turnover ratio This ratio shows the number of times the working capital has been. A Inventory Turnover Ratio and Working Capital Turnover Ratio. Working Capital Current Assets Current Liabilities 18 00000 5 00000 13 00000.

The ratio estimation formula is Current Ratio Current AssetsCurrent Liabilites. These measure short term solvency ie. In Liquidity Rations the following two ratios are included.

Net Credit Sales 18 00000. Working Capital Ratio Current Assets Current Liabilities. Ans b Given that.

Now that we know all the values let us calculate the Working capital turnover ratio for both the companies. The formula to determine the companys working capital turnover ratio is as follows. The formula for calculating this ratio is by dividing the companys sales by the companys working.

Accounting Ratios DK Goel Class 12 Accountancy Solutions. Working capital turnover ratio Net Sales Average working capital. 420000 60000.

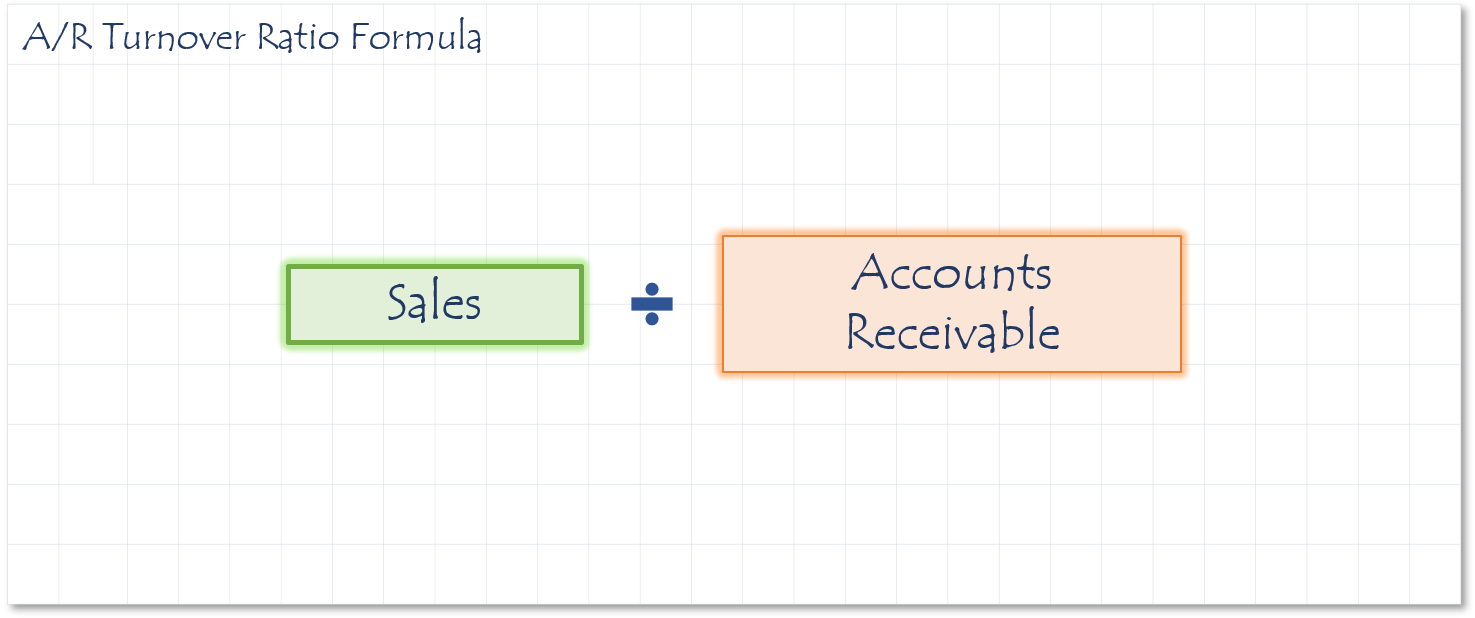

This means that for every 1 spent on the business it is providing net sales of 7. Trade Payable Turnover Ratio Purchases Average Trade Payables Purchases Creditors Bills payable d Working Capital Turnover Ratio. Shareholders fund equity share capital General reserve P L ac- discount on issue of share 50000500015000 - 500065000 Debt equity ratio 20000650000311 ii Working Capital Turnover Ratio.

The firms ability to pay its current dues. Closing creditors and bills payable can be used in the above formula. NCERT Solutions for Class 12 Commerce Accountancy Chapter 5 Accounting Ratios are provided.

Liquid Ratio also called Quick Ratio or Acid Test. Working capital turnover is a measurement comparing the depletion of working capital used to fund operations and purchase inventory which is then converted into sales revenue for the company. As clearly evident Walmart has a negative Working capital turnover ratio of -299 times.

Jen writes the amounts into the working capital turnover ratio formula which is as follows. Class 12 NCERT Accounting Ratios Chapter 5 questions and answers. What this means is that Walmart was able to generate Revenue in spite of having negative working capital.

Current Ratio also called Working Capital Ratio. The working capital turnover ratio is thus 12000000 2000000 60. Working Capital Turnover Ratio Formula.

This means that XYZ Companys working capital turnover ratio for the calendar year was 2. Now working capital Current assets Current liabilities. World-class wealth management using science data and technology leveraged by our experience and human touch.

RD Sharma Class 12 Solutions. 91 9368508813 81087 divine classes jain bagh. Calculate Working Capital turnover Ratio from the following information.

A ratio of 2 is typically an indicator that the company can pay its current liabilities and still maintain its day-to-day operations. Sales current assets - current liabilities or 1000000 500000 - 250000 4. Accounting Ratios Class 12 Accountancy MCQs Pdf.

Working capital turnover ratio Turnover ratio Class 12. It signifies how well a company is generating its sales concerning the working capital. 150000 divided by 75000 2.

700000 Working Capital Turnover Ratio 56 times So the Working Capital Turnover Ratio is 56 times. RD Sharma Class 11 Solutions Free PDF Download.

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula Example And Interpretation

Activity Ratio Formula And Turnover Efficiency Metrics

Activity Ratio Formula And Turnover Efficiency Metrics

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Example And Interpretation

Working Capital Turnover Ratio Formula And Calculator

Working Capital Turnover Ratio Formula And Calculator

How To Calculate Working Capital Turnover Ratio Flow Capital

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

What Are Activity Ratios Formulas And Examples Tutor S Tips

Working Capital Turnover Ratio Meaning Formula Calculation

Debtor Turnover Ratio How To Calculate Debtor Turnover Ratio From Balance Sheet Youtube

Capital Turnover Definition Formula Calculation